October 2021 Market Report

Overall the data indicates a continuation of the very strong and competitive market we’ve been seeing since the rebound from the early days of the pandemic. Somewhat surprisingly we are seeing a downtick in YOY inventory even as we entered the normally very hot fall sales season. After October, we typically see a drastic decline in new listings, but nothing about the market has been typical for some time now.

This report is indicative of single family homes and condos/townhouses in aggregate for the entire city. If you want more granular information based on specific criteria such as neighborhood, number of bedrooms and bathrooms, etc., I’m more than happy to create a report for you.

Single Family Homes

Values for month of Sep 2021

| SEP 2021 | CHANGE FROM AUG 2021 | CHANGE FROM SEP 2020 | |

|---|---|---|---|

| Homes sold | 235 | -2.9% | -13% |

| Homes for sale | 330 | +5.1% | -60% |

| Median days on market | 13 | 0% | -24% |

| Median price per square foot | $1,100 | +2.4% | +17% |

| Months of inventory | 1.4 | +8.2% | -55% |

| Median sold price | $1,750,000 | -4.1% | +11% |

| Homes under contract | 346 | +52% | +13% |

Inventory

New listings

New Listing numbers represent the number of properties that were newly listed for that period. A downward trend of listing inventory and an upward trend of the number of properties sold indicates the seller is in a better negotiating position. An upward trend of listing inventory and a downward trend of the number of properties sold indicates the buyer is in a better negotiating position.

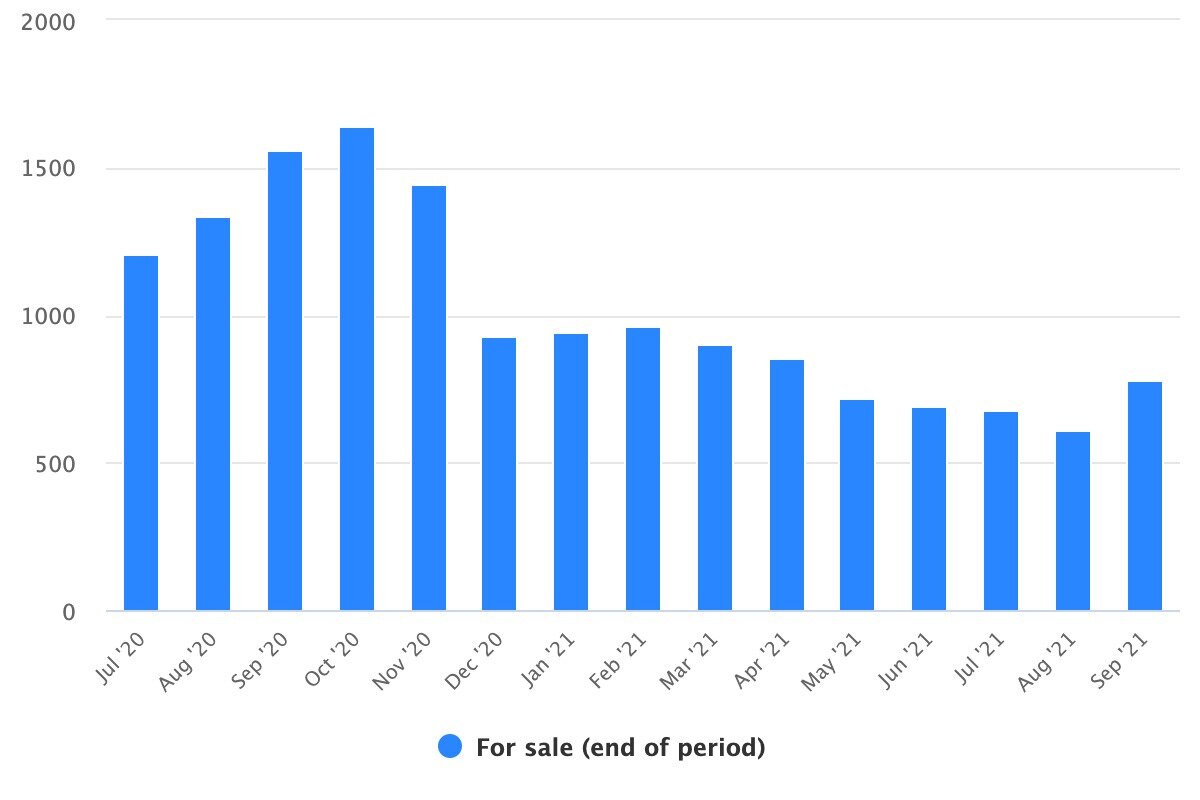

For sale (end of period)

For Sale metrics are a snapshot of the number of properties for sale (active) on the last day of the selected period (eg. end of month, quarter, year, etc.). This generally leads to a cleaner, more accurate number for calculating Months Supply of Inventory and surfacing trends because it excludes the complexity of back & forth status changes throughout the period. Reference this NAR post for more information. A downward trend of For Sale inventory and an upward trend of the number of properties sold indicates the seller is in a better negotiating position. An upward trend of For Sale inventory and a downward trend of the number of properties sold indicates the buyer is in a better negotiating position.

Sold and under contract

Sold numbers represent the number of properties that were sold for the selected time period. Under Contract numbers represent the number of properties that went “under contract” or “pending” status for that period. The properties sold figures are derived from recorded transactions. Current monthly sold figures might be adjusted upward on subsequent reports to account for any closed transactions that are reported late.

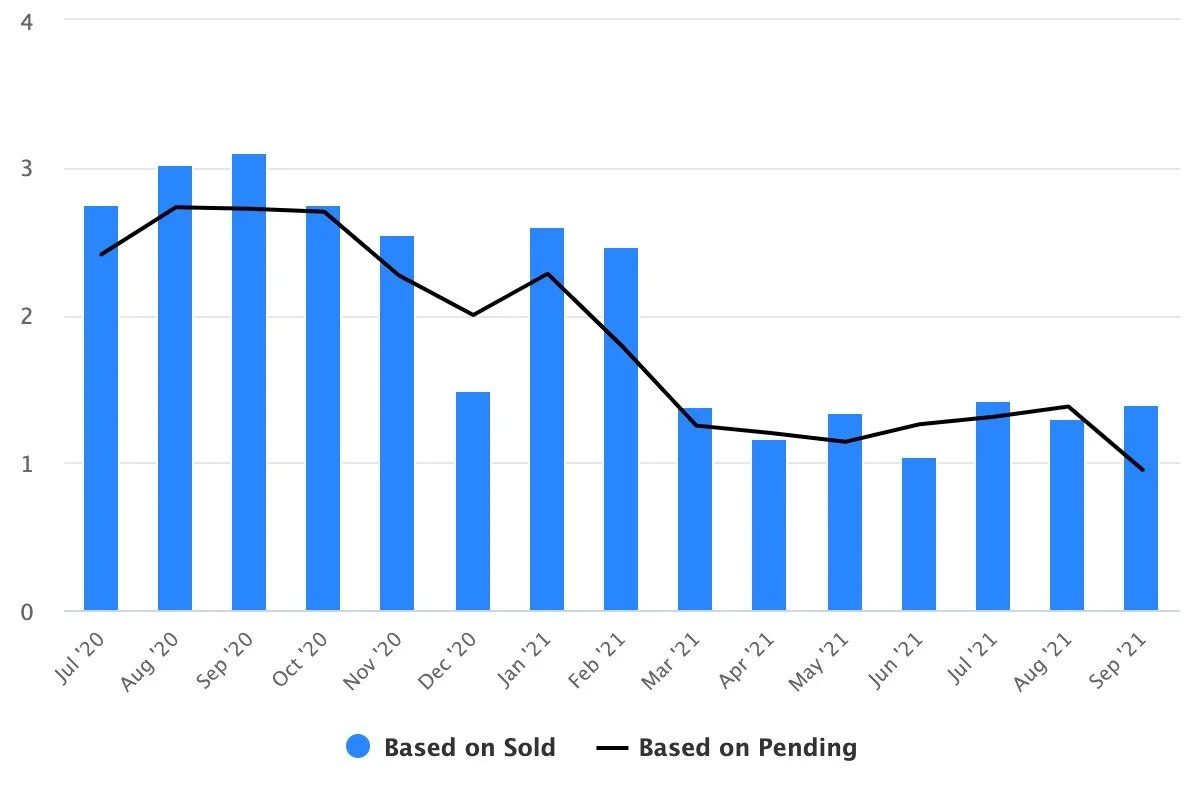

Months of inventory

There are 2 kinds of Months of Inventory (MOI): MOI based on Closed Sales = the number of properties for sale divided by the number of properties sold. MOI based on Under Contract Sales = the number of properties for sale divided by the number of properties under contract.

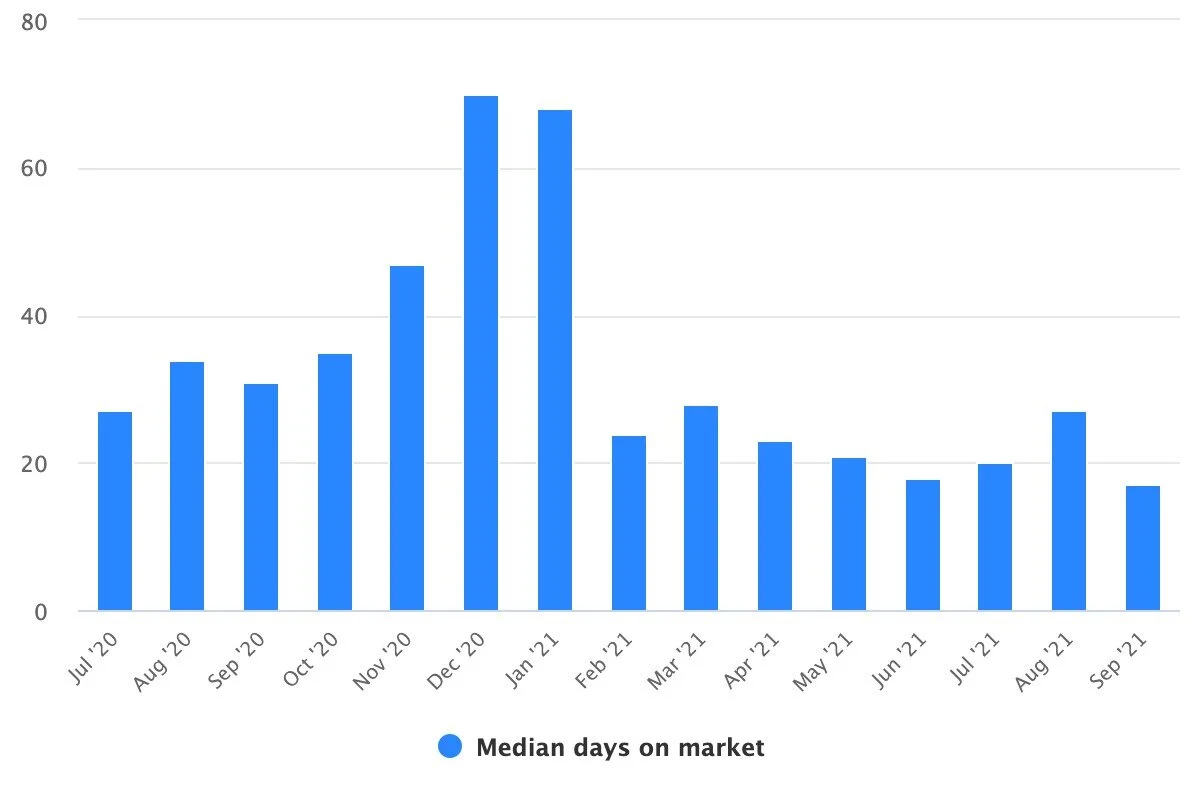

Median days on market

DOM generally is between the day the property is listed and the day it becomes off market (eg. when it goes under contract). A listing’s DOM counts up by one every day the property remains unsold. A low median / average DOM indicates a strong market that favors sellers. A high median / average DOM signals a weak market that favors buyers.

Price

Median sold price

Median or Average Sold Price For Sale is the median or average calculation of the properties sold in a particular period. It helps identify where the softest market is and where the buyer can find the biggest price concessions. If a very expensive or very cheap home has been sold, average statistics can be skewed up or down, and the trend line can fluctuate with less consistency. In these cases the median metric may be of more value since median is the price where half of the homes sold were cheaper, and half were more expensive. Median tends to be less sensitive to outliers. When combined with the Sold Price / Original List Price % Difference Report, these metrics can portray the relationship between on and off market pricing.

Median price per square foot

Median / Average Price per Sqft is the median or average calculation of sold price divided by square footage of sold listings within a given period. Use the highest and lowest monthly average price per square foot on the chart to establish the most marketable price range in a specific area. If the home has a larger than normal lot, a special amenity, or is located in an area of social demand, the home price must be adjusted upward.If there are less than five properties sold per month for a specific price range, the average price per square foot might be skewed and is not as useful. In this case, an average of the time period should be used in setting the price. The garage area is not included in the square footage price calculation. Individual listings in the MLS system without square foot information are excluded in the average square foot price calculation.

Sold price/original list price %

Also known as the Sale-to-List Ratio or “Negotiability” metric. When a property is listed on the market, the list price may change one or more times before it is sold. Original list price is the price that is first entered to the MLS database when a property is listed on the market. This report represents the percentage difference between sold price and original list price of properties sold in a given time period. If the percentage difference is above 100%, the home sold for more than the original list price. If it's less than 100%, the home sold for less than the list price.

| Date | Median sold price | Median sold $/sqft | Median DOM | Active | Sold | Under contract |

|---|---|---|---|---|---|---|

| Jul '20 | $1,570,000 | $984 | 16 | 671 | 244 | 279 |

| Aug '20 | $1,600,000 | $992 | 19 | 724 | 239 | 265 |

| Sep '20 | $1,570,000 | $939 | 17 | 834 | 269 | 307 |

| Oct '20 | $1,570,000 | $980 | 21 | 884 | 321 | 328 |

| Nov '20 | $1,610,000 | $994 | 27 | 736 | 289 | 324 |

| Dec '20 | $1,510,000 | $961 | 39 | 461 | 310 | 230 |

| Jan '21 | $1,520,000 | $934 | 35 | 467 | 179 | 205 |

| Feb '21 | $1,550,000 | $974 | 13 | 457 | 185 | 256 |

| Mar '21 | $1,670,000 | $1,057 | 12 | 406 | 295 | 324 |

| Apr '21 | $1,735,000 | $1,023 | 12 | 374 | 320 | 311 |

| May '21 | $1,835,000 | $1,063 | 11 | 345 | 258 | 303 |

| Jun '21 | $1,915,000 | $1,088 | 12 | 337 | 323 | 267 |

| Jul '21 | $1,855,000 | $1,119 | 13 | 336 | 235 | 256 |

| Aug '21 | $1,825,000 | $1,074 | 13 | 314 | 242 | 227 |

| Sep '21 | $1,750,000 | $1,100 | 13 | 330 | 235 | 346 |

Condos

Values for month of September 2021

| SEP 2021 | CHANGE FROM AUG 2021 | CHANGE FROM SEP 2020 | |

|---|---|---|---|

| Homes sold | 243 | -18% | -14% |

| Homes for sale | 779 | +28% | -50% |

| Median days on market | 17 | -37% | -45% |

| Median price per square foot | $1,116 | +1.2% | +5.8% |

| Months of inventory | 3.2 | +57% | -42% |

| Median sold price | $1,200,000 | +2% | +1.7% |

| Homes under contract | 368 | +28% | +34% |

Inventory

New listings

New Listing numbers represent the number of properties that were newly listed for that period. A downward trend of listing inventory and an upward trend of the number of properties sold indicates the seller is in a better negotiating position. An upward trend of listing inventory and a downward trend of the number of properties sold indicates the buyer is in a better negotiating position.

For sale (end of period)

For Sale metrics are a snapshot of the number of properties for sale (active) on the last day of the selected period (eg. end of month, quarter, year, etc.). This generally leads to a cleaner, more accurate number for calculating Months Supply of Inventory and surfacing trends because it excludes the complexity of back & forth status changes throughout the period. Reference this NAR post for more information. A downward trend of For Sale inventory and an upward trend of the number of properties sold indicates the seller is in a better negotiating position. An upward trend of For Sale inventory and a downward trend of the number of properties sold indicates the buyer is in a better negotiating position.

Sold and under contract

Sold numbers represent the number of properties that were sold for the selected time period. Under Contract numbers represent the number of properties that went “under contract” or “pending” status for that period. The properties sold figures are derived from recorded transactions. Current monthly sold figures might be adjusted upward on subsequent reports to account for any closed transactions that are reported late.

Median days on market

DOM generally is between the day the property is listed and the day it becomes off market (eg. when it goes under contract). A listing’s DOM counts up by one every day the property remains unsold. A low median / average DOM indicates a strong market that favors sellers. A high median / average DOM signals a weak market that favors buyers.

Months of inventory

There are 2 kinds of Months of Inventory (MOI): MOI based on Closed Sales = the number of properties for sale divided by the number of properties sold. MOI based on Under Contract Sales = the number of properties for sale divided by the number of properties under contract.

Price

Median sold price

Median or Average Sold Price For Sale is the median or average calculation of the properties sold in a particular period. It helps identify where the softest market is and where the buyer can find the biggest price concessions. If a very expensive or very cheap home has been sold, average statistics can be skewed up or down, and the trend line can fluctuate with less consistency. In these cases the median metric may be of more value since median is the price where half of the homes sold were cheaper, and half were more expensive. Median tends to be less sensitive to outliers. When combined with the Sold Price / Original List Price % Difference Report, these metrics can portray the relationship between on and off market pricing.

Median price per square foot

Median / Average Price per Sqft is the median or average calculation of sold price divided by square footage of sold listings within a given period. Use the highest and lowest monthly average price per square foot on the chart to establish the most marketable price range in a specific area. If the home has a larger than normal lot, a special amenity, or is located in an area of social demand, the home price must be adjusted upward.If there are less than five properties sold per month for a specific price range, the average price per square foot might be skewed and is not as useful. In this case, an average of the time period should be used in setting the price. The garage area is not included in the square footage price calculation. Individual listings in the MLS system without square foot information are excluded in the average square foot price calculation.

Sold price/original list price %

Also known as the Sale-to-List Ratio or “Negotiability” metric. When a property is listed on the market, the list price may change one or more times before it is sold. Original list price is the price that is first entered to the MLS database when a property is listed on the market. This report represents the percentage difference between sold price and original list price of properties sold in a given time period. If the percentage difference is above 100%, the home sold for more than the original list price. If it's less than 100%, the home sold for less than the list price.

| Date | Median sold price | Median sold $/sqft | Median DOM | Active | Sold | Under contract |

|---|---|---|---|---|---|---|

| Jul '20 | $1,275,000 | $1,148 | 27 | 1209 | 231 | 223 |

| Aug '20 | $1,240,000 | $1,099 | 34 | 1338 | 217 | 297 |

| Sep '20 | $1,180,000 | $1,055 | 31 | 1558 | 282 | 274 |

| Oct '20 | $1,165,000 | $1,021 | 35 | 1643 | 264 | 307 |

| Nov '20 | $1,200,000 | $1,021 | 47 | 1445 | 305 | 281 |

| Dec '20 | $1,100,000 | $1,017 | 70 | 928 | 324 | 295 |

| Jan '21 | $1,075,000 | $1,026 | 68 | 943 | 241 | 276 |

| Feb '21 | $1,195,000 | $1,079 | 24 | 960 | 244 | 336 |

| Mar '21 | $1,221,184 | $1,082 | 28 | 905 | 413 | 416 |

| Apr '21 | $1,205,000 | $1,077 | 23 | 855 | 407 | 431 |

| May '21 | $1,230,000 | $1,102 | 21 | 720 | 397 | 423 |

| Jun '21 | $1,275,000 | $1,142 | 18 | 694 | 416 | 322 |

| Jul '21 | $1,240,000 | $1,119 | 20 | 676 | 286 | 314 |

| Aug '21 | $1,176,000 | $1,103 | 27 | 609 | 298 | 287 |

| Sep '21 | $1,200,000 | $1,116 | 17 | 779 | 243 | 368 |