August 2021 Market Report

Image by Patricia Silva, @patrix15 on Instagram. Used with permission.

The first half of 2021 delivered big results, with plenty of new highs:

Dollar-volume sales beat the previous high by nearly half

New listing and sales volume almost as high as 2015-2016

Median house sales prices continue to escalate to ever new highs

Overbidding is back in a big way

Luxury house sales have skyrocketed

Interest rates are back to near-historic lows, fueling the sales frenzy

See the charts below to further understand the state of the market.

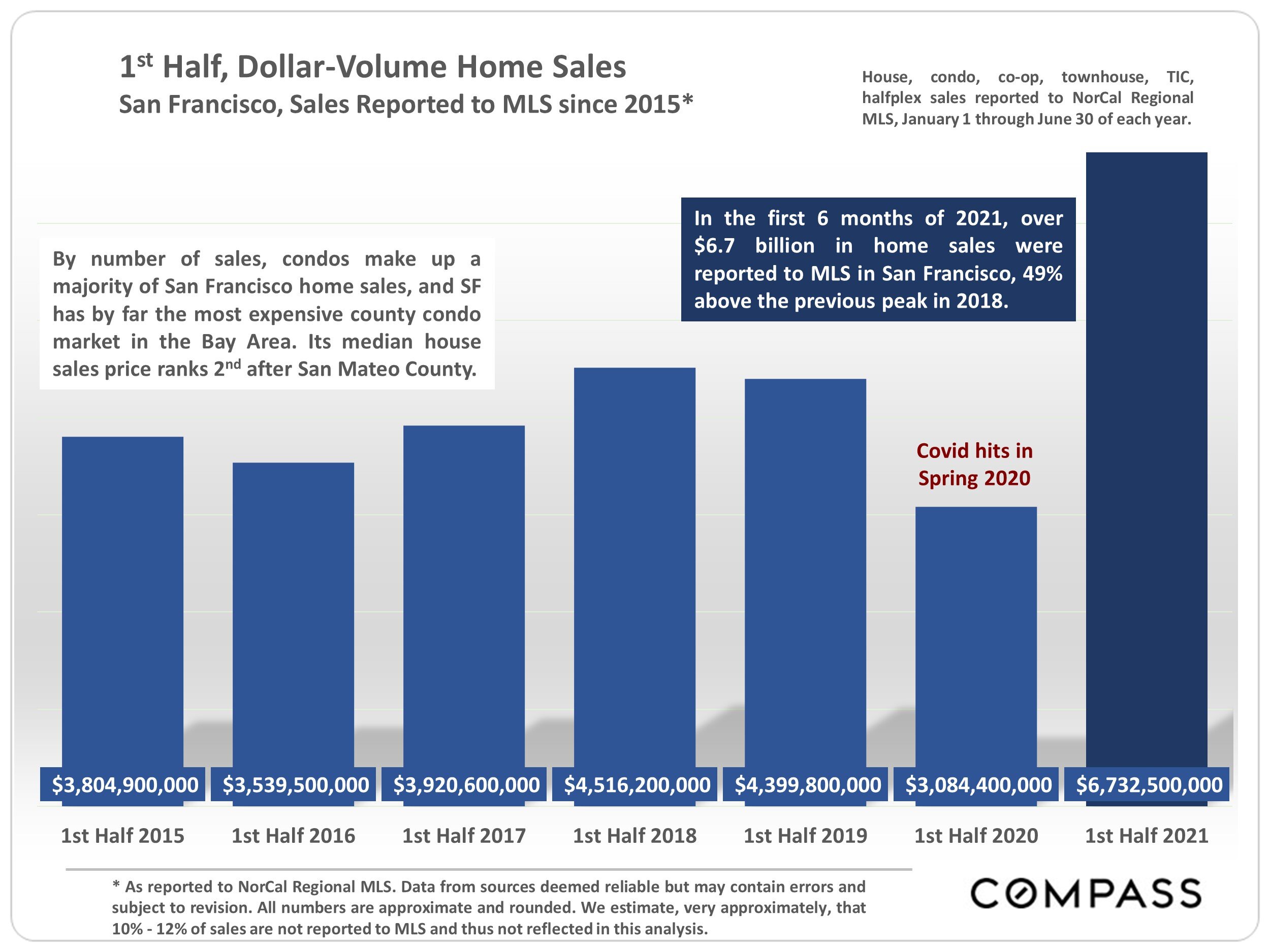

1st Half, Dollar-Volume Home Sales

San Francisco, Sales Reported to MLS since 2015*

By number of sales, condos make up a majority of San Francisco home sales, and SF has by far the most expensive county condo market in the Bay Area. Its median house sales price ranks 2nd after San Mateo County. House, condo, co-op, townhouse, TIC, halfplex sales reported to NorCal Regional MIS, January 1 through June 30 of each year. In the first 6 months of 2021, over $6.7 billion in home sales were reported to MLS in San Francisco, 49% above the previous peak in 2018.

* As reported to NorCal Regional MLS. Data from sources deemed reliable but may contain errors and subject to revision. All numbers are approximate and rounded. We estimate, very approximately, that 10% - 12% of sales are not reported to MLS and thus not reflected in this analysis.

New Listing & Sales Volumes, Longer-Term Trends since 2005

San Francisco, 12-Month Rolling Data*

After the pandemic struck, the numbers of new listings and closed sales both climbed to 15-16 year highs.

12-month rolling data delivers broad, clear, long-term trend lines, but may disguise and lag shorter term changes.

* Each data point reflects the total of 12 months of activity for houses, condos, co-ops, TICS and townhouses. 1/12 of these numbers = an average month within the 12 month period. Sales reported to MLS, per NorCal Regional MLS, per Infosparks. Last month estimated from data available in early August. Data from sources deemed reliable, but may contain errors and subject to revision. Numbers are approximate.

San Francisco Home Price Appreciation

Monthly Median House Sales Prices, 6-Month Rolling Average, since 1990

Median sales price is that price at which half the sales occurred for more and half for less. It is a very general statistic often affected by factors other than changes in fair market value. Seasonal fluctuations are common. Longer-term trends are more meaningful than short-term changes.

6-month rolling average of the monthly median sales prices for "existing" houses since 1990, per CA Association of Realtors or NorCal Regional MLS data. Analysis may contain errors and subject to revision. All numbers are approximate. Last month figure estimated from data available early in following month.

San Francisco Median Condo Sales Price Trends

Monthly Median Sales Prices since 2005 - 6-Month Rolling Figures

Sales reported to NorCal Regional MLS, per Infosparks through July 2021

The SF condo median sales price has ticked back up in 2021, but remains a little below its 2019 & 2020 peaks (on a 6-month rolling basis).

Each median sales price on this chart reflects 6 months of sales. Median sales prices are subject to seasonal fluctuation, among other factors.

Median sales price is that price at which half the sales occurred for more and half for less. It is a very general statistic often affected by factors other than changes in fair market value. Data from sources deemed reliable, but may contain errors and subject to revision.All numbers approximate.

New Listings Coming on Market

San Francisco Real Estate Market Dynamics by Month

House, condo, co-op, TIC listings posted to MLS

Typically, new listings climb in spring, fall in summer, spike up dramatically in early autumn, then plunge in mid-winter. In 2020, the pandemic upended normal seasonal trends, but in 2021, the market appears to have reverted to the norm.

As reported to NorCal Regional MLS, per Infosparks. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate. Last month estimated on available data.

San Francisco Short-Term Market Dynamics & Seasonality

Listings Accepting Offers (Going into Contract) by Month

Typically, the market ebbs and flows by season, though the pandemic upended trends in 2020. In summer 2021, activity (new listings, offers being accepted) began to decline from spring peaks, an apparent reversion to seasonal norms — though the number of listings going into contract remained much higher than in typical summers (2018, 2019).

As reported to NorCal Regional MLS, per Infosparks. Does not include activity unreported to MLS. Last month's number estimated from data available in early August. Data from sources deemed reliable but may contain errors and subject to revision. All numbers to be considered approximate.

San Francisco Short-Term Market Dynamics & Seasonality

Closed Sales Volume by Month

Closed sales typically follow offers being accepted by 3 to 5 weeks. Sales closing in June mostly reflect market activity in May.

As reported to NorCal Regional MLS, per Infosparks. Does not include activity unreported to MLS. Last month's number estimated from data available in early August. Data from sources deemed reliable but may contain errors and subject to revision. All numbers to be considered approximate.

San Francisco Market: Buyer Demand & Overbidding

Average Sales Price to Original List Price %, since 2018, 3-Month Rolling Data

Overbidding is typically generated by buyer competition for new listings (though strategic underpricing by agents and sellers can exacerbate overbidding). Both house and condo markets have seen soaring demand since the new year began. 116% signifies an average sales price 16% over the original list price.

NorCal Regional MLS data per Infosparks. Last reading may change with late reported activity. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate.

Median House Sales Price Trends

Selected San Francisco Neighborhoods, since 2012

House sales reported to NorCal Regional MLS by 7/24/21

San Francisco Luxury House Market

Sales & Active Listings by Price Segment, $3 Million+

As reported to MLS. "Active" includes "Coming Soon" listings. Not all luxury home listing and sales are reported to MLS. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate.

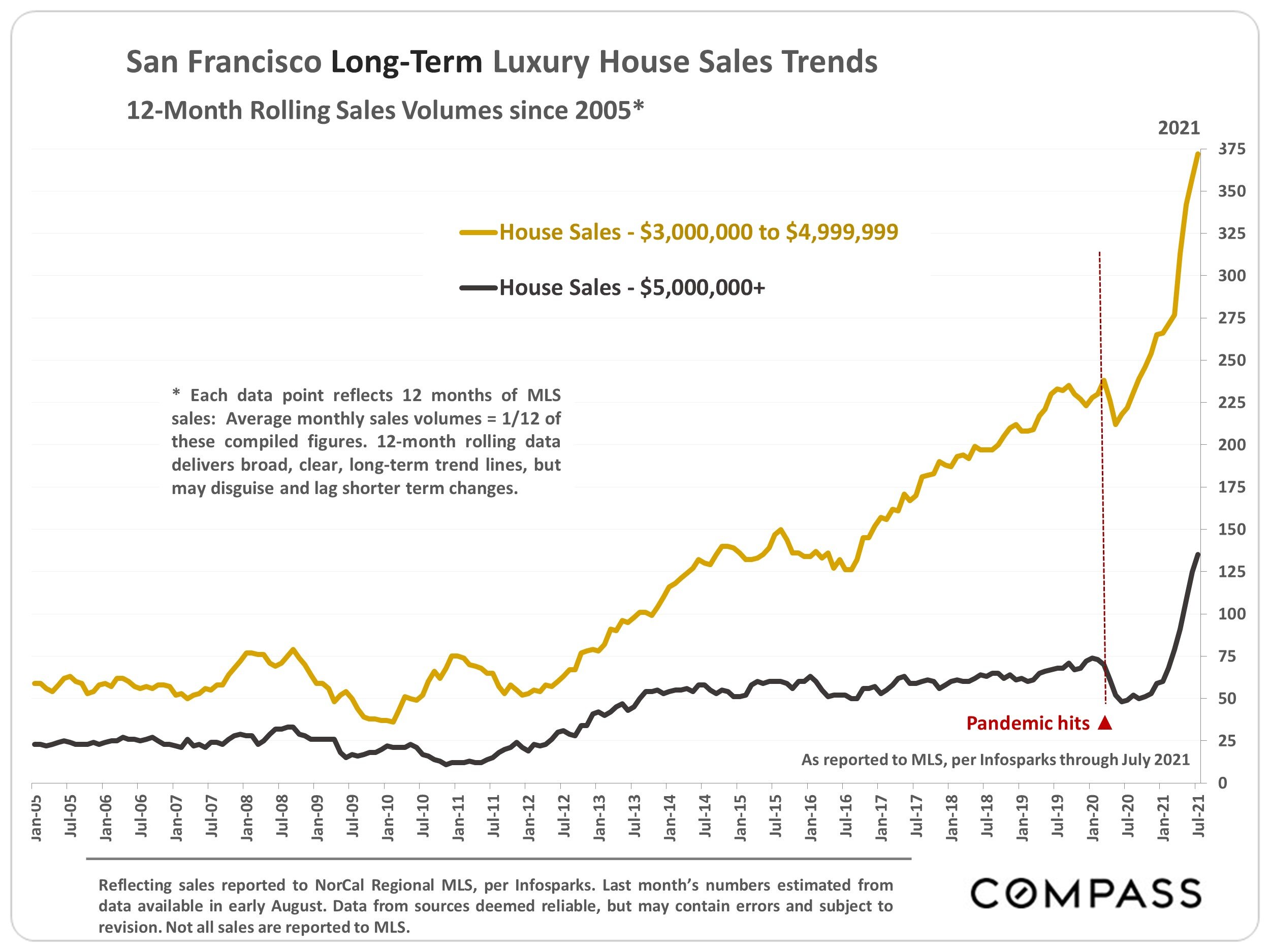

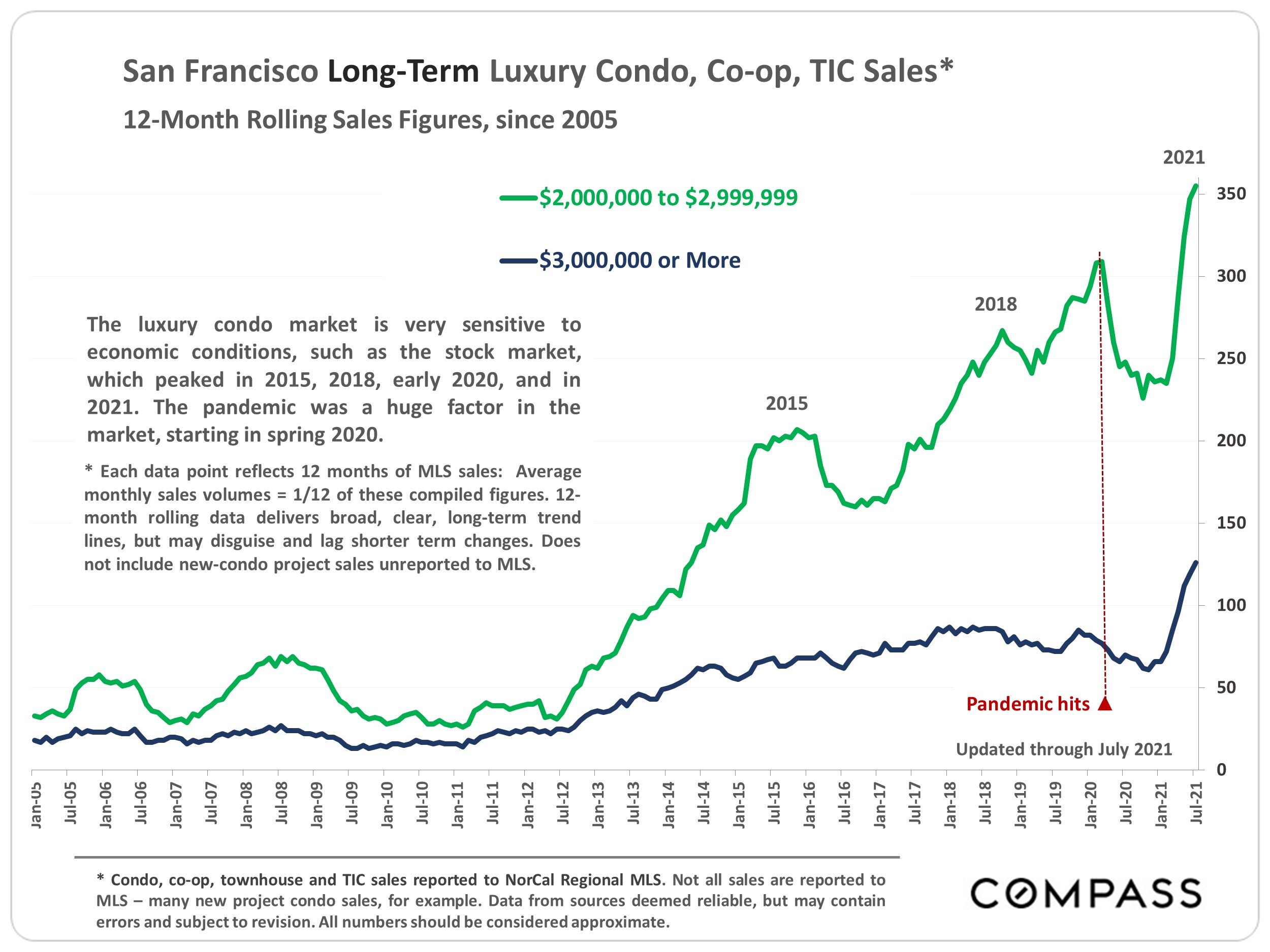

San Francisco Long-Term Luxury House AND CONDO Sales Trends

12-Month Rolling Sales Volumes since 2005*

* Each data point reflects 12 months of MLS sales: Average monthly sales volumes = 1/12 of these compiled figures. 12-month rolling data delivers broad, clear, long-term trend lines, but may disguise and lag shorter term changes.

Reflecting sales reported to NorCal Regional MLS, per Infosparks. Last month's numbers estimated from data available in early August. Data from sources deemed reliable, but may contain errors and subject to revision. Not all sales are reported to MLS.

San Francisco Short-Term Luxury Market Dynamics & Seasonality

Listings Accepting Offers (Going into Contract) by Month

Houses, condos, co-ops, town-houses and TICs as listed in MLS.

Homes Going into Contract, Priced $3 Million & Above

Typically, luxury market activity ebbs and flows by season, though the pandemic upended normal trends in 2020. In summer 2021, activity declined from spring peaks, an apparent reversion to seasonal norms — but activity was much higher than in typical summers.

As reported to NorCal Regional MLS, per Infosparks. Does not include activity unreported to MLS. Last month's number estimated from data available in early August. Data from sources deemed reliable but may contain errors and subject to revision. All numbers to be considered approximate.

Steep U.S. Decline in Foreign National Homebuyers

Estimated Dollar Volume Sales in Billions, Top 5 Countries

Since 2017, dollar volume home purchases by foreign nationals of all countries have declined by approximately 64%. As illustrated in this chart, declines have been larger in 4 of the top 5 countries. Over the past year, the drop was 26.5%. A variety of economic and political factors, plus the pandemic, have been at play. The Bay Area has typically been a major market for foreign homebuyers.

Years designated reflect estimated sales from April of the previous year through March of the year specified: Purchases by resident and non-resident foreign nationals.

Estimates from the "2021 Profile of International Transactions in U.S. Residential Real Estate" published by the National Association of Realtors in July 2021, based upon a survey of Realtors. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers to be considered approximate, good-faith estimates. China includes the People's Republic, Hong Kong and Taiwan.

Mortgage Interest Rate Trends, November 2018 — Present

30-Year & 15-Year Conforming Fixed Rate Loans, Weekly Average Readings

Per Freddie Mac, on August 5, 2021, the weekly average interest rate for a 30-year fixed-rate mortgage was 2.77%, slightly above its nadir in January (2.65%), and the 15-year rate was at a historic low at 2.1%. In November 2018, the 30-year rate hit 4.94%, and in 2007, it was 6.3%.

Nov. Interest rates may fluctuate suddenly and dramatically, and it is very difficult to predict rate 2018 changes. Data from sources deemed reliable but not guaranteed. Anyone interested in residential home loans should consult with a qualified mortgage professional and their accountant.

S&P 500 Stock Index, 1995 - 2021

By Month through July 2021

Data from multpl.com and Yahoo! Finance. An approximate illustration only. Data from sources deemed reliable but may contain errors and subject to revision. Financial markets can be prone to significant volatility even on a short-term basis. For general illustration purposes only.

Statistics are generalities, essentially summaries of widely disparate data generated by dozens or hundreds of unique, individual sales occurring within different time periods. They are best seen not as precise measurements, but as broad, comparative indicators, with reasonable margins of error. Anomalous fluctuations in statistics are not uncommon, especially in smaller, expensive market segments. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers are approximate. Data from MLS, but not all listings or sales are reported to MLS.

Median Sales Price is that price at which half the properties sold for more and half for less. It may be affected by seasonality, "unusual" events, or changes in inventory and buying trends, as well as by changes in fair market value. The median sales price for an area will often conceal an enormous variety of sales prices in the underlying individual sales.

Dollar per Square Foot is based upon the home's interior living space and does not include garages, unfinished attics and basements, rooms built without permit, patios, decks or yards (though all those can add value to a home). These figures are usually derived from appraisals or tax records, but are sometimes unreliable (especially for older homes) or unreported altogether. The calculation can only be made on those home sales that reported square footage.

Many aspects of value cannot be adequately reflected in median and average statistics: curb appeal, age, condition, amenities, views, lot size, quality of outdoor space, "bonus" rooms, additional parking, quality of location within the neighborhood, and so forth. How these statistics apply to any particular home is unknown without a specific comparative market analysis.

Compass is a real estate broker licensed by the State of California, DRE 01527235. Equal Housing Opportunity. This report has been prepared solely for information purposes. The information herein is based on or derived from information generally available to the public and/or from sources believed to be reliable. No representation or warranty can be given with respect to the accuracy or completeness of the information. Compass disclaims any and all liability relating to this report, including without limitation any express or implied representations or warranties for statements contained in, and omissions from, the report. Nothing contained herein is intended to be or should be read as any regulatory, legal, tax, accounting or other advice and Compass does not provide such advice. All opinions are subject to change without notice. Compass makes no representation regarding the accuracy of any statements regarding any references to the laws, statutes or regulations of any state are those of the author(s). Past performance is no guarantee of future results.