Another Feverish Spring Market?

San Francisco Real Estate: Here We Go Again? Preliminary Indications Signal another Feverish Spring Market

Preliminary statistics and, even more so, indications on the ground in the current hurly burly of deal-making are sending strong signals of another very competitive real estate market in San Francisco as we approach spring. If it continues to develop as it’s looking right now, this would make the 4th intense spring season since the market recovery began in early 2012.

Once again, buyer demand has surged early in the new year without a corresponding increase in listing inventory: High demand meets low supply generates competitive bidding – sometimes fiercely so – and upward pressure on home prices. This doesn’t mean every listing is selling over asking price or even selling at all – even in a red hot market, 20% – 30% of homes are price reduced before selling or withdrawn from the market without a sale taking place (usually due to overpricing). There are also hotter and cooler pockets within the market: Right now, more affordable homes – for example, condos under $1 million – appear to be in particularly high demand.

Sales statistics of one month generally reflect offers negotiated 4 – 6 weeks earlier, i.e. they are a month or so behind what’s actually occurring in the market as buyers and sellers make deals. Sales volume in January and February was down 20% year over year, reflecting a market that pretty much shut down in the last two weeks in December, and then started the year with extremely low inventory.

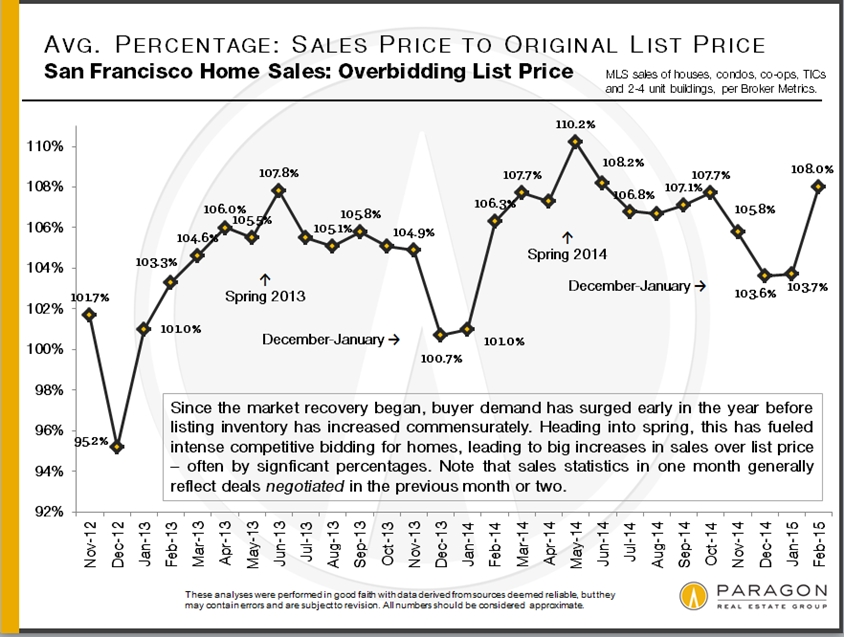

Overbidding List Prices

This chart above illustrates seasonal trends in competitive bidding, which underlies the phenomenon of homes selling for over asking price. For the last few years, the average percentage of sales price to list price has been peaking in spring. But already in February, prices averaged a whopping 8% above asking – very few other markets in the country are seeing anything similar. Drilling down by property type, SF house sales in February averaged 12% over asking, condos averaged 7% over, and 2-4 unit buildings 2%. Houses are becoming a smaller and smaller percentage of city home sales (since virtually no new ones are being built), which has generally made them the most competitive market segment.

In previous years, the percentage over asking has peaked in May, reflecting offers negotiated in late March, April and early May.

Housing Inventory

Seasonality in the Bay Area often has more to do with summer and winter holidays than the actual weather since, unlike back east, January and February often look more like spring here. New listings and overall inventory bottom out in December, and then slowly rise in the new year. What is super-charging the market is that buyers woke up after the holidays and jumped back in the market much earlier than sellers have put homes up for sale in quantity. For the past 3 years, this unbalanced dynamic between the high pressure of buyer demand pushing against an insufficient supply of listings continued through spring, causing dramatic home-price increases, until the market slowed during the summer. We shall soon see if prices can jump higher once again in coming months.