Of San Francisco Real Estate, Gold, & Apple Stock

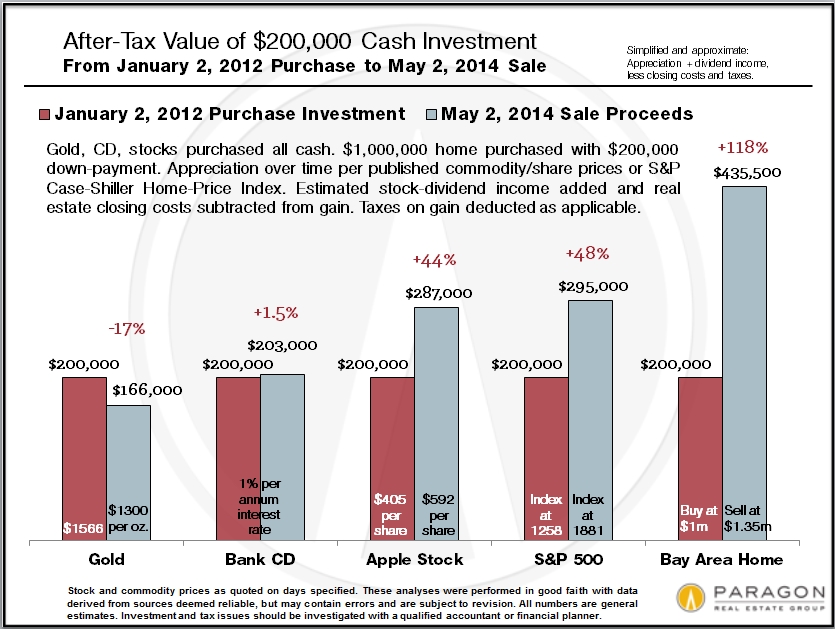

On January 1, 2012, you woke up to find $200,000 on your bedside table, which you decided to invest. Then, on May 2, 2014, you sold your investment. Below are approximate returns depending on where you placed your cash.

Assumptions:

Gold: you bought at $1566 per ounce and sold at $1300 per ounce: Bad timing.

Certificate of Deposit: 1% annual interest rate; interest taxed as ordinary income: It seemed like the safe thing to do in an uncertain world.

Stock purchases: Apple stock jumped 46% and the S&P 500 50%; plus an estimated dividend yield of 5%; profit taxed as long-term capital gains. (No transaction costs included in calculation.)

Home purchase: $200,000 down-payment on $1 million home; 35% home-price appreciation per Case-Shiller; 2% closing costs on purchase and 7% on sale deducted from gain. No capital gains tax due to the $250,000/$500,000 exclusion for sale of primary residence. The estimated $28,000 reduction in loan principal was not included in gain, as it pertains to monthly home payments made after initial investment.

It is assumed that the net monthly home cost - principal, interest, property taxes and insurance, after tax deductions and reduction in loan principal - at an estimated $3250/month, was comparable to cost of renting. This has generally been true in San Francisco due to high rents and low interest rates.

There are 3 big reasons why real estate dramatically outperformed the stock market, though both markets boomed: 1) leverage - 35% home-price appreciation equals 175% appreciation of your 20% cash down-payment (before closing costs); 2) big tax deductions subsidize home ownership costs, and 3) the capital gains exclusion on the sale of a primary residence.

Important: Timing is everything in investing. In this analysis, the chosen buy date was January 2, 2012 when the financial and housing markets were poised for big rebounds. Picking a different purchase date, such as January 2, 2008, would completely alter the results. *

* The investment analysis above is simply one scenario based on specific circumstances. It was performed in good faith, but may contain errors or assumptions you may disagree with, or may not apply to your specific tax situation. Investment and tax issues should be investigated with a qualified accountant or financial planner.